Aroon Indicator was developed by Tushar Chande in 1995. It belongs to trend indicators of technical analysis so its main task is to identify the prevailing trend on the market and the likelihood of change in trend. Alike another popular trend indicators - ADX or RWI it consists of two smaller sub-indicators - Aroon Up and Aroon Down. Aroon Up measures the strength of an uptrend while Aroon Down measures the strength of a downtrend.

The formula for Aroon indicator calculation looks like follows:

Aroon Up = [(n – nHC)/(n)] * 100

Aroon Down = [(n – nLC)/(n)] * 100

n = the number of days included in the calculation

nHC = the number of days since the Highest Close

nLC = the number of days since the Lowest Close

Let’s suppose that a new Highest Close has been reached and at the same time that is has been 4 days since the Lowest Close has been recorded. According to the explanation above, the Aroon Up indicator would be 100 percents. The Aroon down indicator would be 60 percents [4 days * (1/10) * 100]. Compared to ADX we can say that ADX measures the strength of the current trend based on everyday gains and losses of price Highs and Lows while Aroon shows the strength of the prevailing trend based on the number of days since the previous maximum and minimum values have been reached.

And the picture below shows how all these indicators look in a chart (the indicators and oscillator are set to 17 days). Red curve stands for Aroon down, green curve displays Aroon up and the blue curve stands for composite Aroon oscillator.

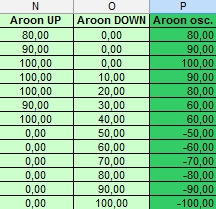

As you can see, the Aroon oscillator is just the difference between Aroon Up and Aroon Down. Its values move in the range of -100 to +100 percents. Should the Aroon Up be 100 percents and the Aroon Down 0 percents then Aroon Oscillator would show +100 percents. Should the Aroon Up be 20 percents and Aroon Down 80 percents then the oscillator would be -60 points. Of course, there are other ways how to reach the value of -60 points – e.g. Aroon Up equals 40 and Aroon down equals -100 percents. In other words the Aroon Oscillator shows us the strength of Uptrend and Downtrend as one number. It identifies the prevailing trend on the market and its strength. The closer to the positive +100 points the oscillator is, the stronger the Bulls are. The closer to the negative -100 points the oscillator moves, the stronger the Bears are. You can see an example of Aroon oscillator calculation in the image below.

It is commonly written in many articles that the Aroon oscillator values around 0 indicate an absence of a trend and that market can not create any Highest Close or Lowest Close. That is just half of the truth. Values around 0 can also indicate high Aroon Up and high Aroon Down values (that means both trends are strong enough). The high values can cancel each other and the oscillator shows us that despite the strong Uptrend and Downtrend neither of them dominates (see the image below).

How to use the Aroon indicator for trading:

- Aroon oscillator is used to identify the prevailing trend on the market. So first of all we can use it in combination with any other indicators of technical analysis that can reveal us the right moment to buy or sell.

For example we can use Aroon oscillator + RSI indicator (Aroon shows a long-lasting positive trend that has just begun to attenuate, RSI shows e.g. overbought conditions and has just cross the 80 point level downwards, so we can expect end of the current trend and go short). The same is true for other counter-trend oscillators (e.g. Stochastics oscillators, William’s percentage range etc.). We can also it for trading when Aroon oscillator reaches low numbers (it oscillates around zero line). In such case neither the positive nor negative trend dominates so it can be a good idea to use one of the counter-trend oscillators to generate buy and sell signals. - We can use Aroon oscillator to choose trades in line with the prevailing trend – e. g. with Bollinger Bands. If Aroon oscillator reaches high positive values that indicate a strong Uptrend, we can wait while the price moves from the upper band of Bollinger bands indicator to its middle, bounces from this level and at that point we go long.

- Moreover, we can use just the Aroon Up and Down values and their crossings. When Aroon Up values crosses the Aroon Down values upwards (Aroon oscillator shows positive values) we go long and vice versa (in such case the shortest periods for Aroon indicator calculation can achieve better results than the longer settings). These rules are valid especially for short-term traders. Long-term investors prefer longer periods and they can also use it in a different way. For example, they use horizontal signal lines that are set to e.g. 70 points (for Aroon oscillator). The longer settings plus the horizontal signal lines are not meant to catch all the ups and downs but to profit from the longer trends when they become strong enough. Example: Aroon oscillator values are above 70 points (this indicates strong Uptrend). When the values fall below this horizontal line, investors don’t go automatically short but wait until the values fall below negative -70 points. This level absorbs most pullback of the previous trend and is strong enough to signal the start of a downtrend. Similarly, investors go long just after the oscillator values cross positive +70 point level upwards.

- Some other traders search for positive and negative divergences with the price chart but this way of using it is quite questionable. The indicator was not developed for such trading as it is bit of delayed/modified (it filters prices until a new Highest Close or Lowest Close is not recorded).

As with all of the technical analysis indicators the best thing every trader can do is to test his own data, his own settings, and his own rules how to trade. Surprisingly, sometimes the best result can be achieved with settings that are not common and rules that are quite strange at a first glance – the more things a trader can change and experiment with the better for him and his trading results.

If you are interested in a deeper study of this technical indicator and prefer ready solutions, this section may be of interest to you. There are all the available technical indicators in Excel files for download.